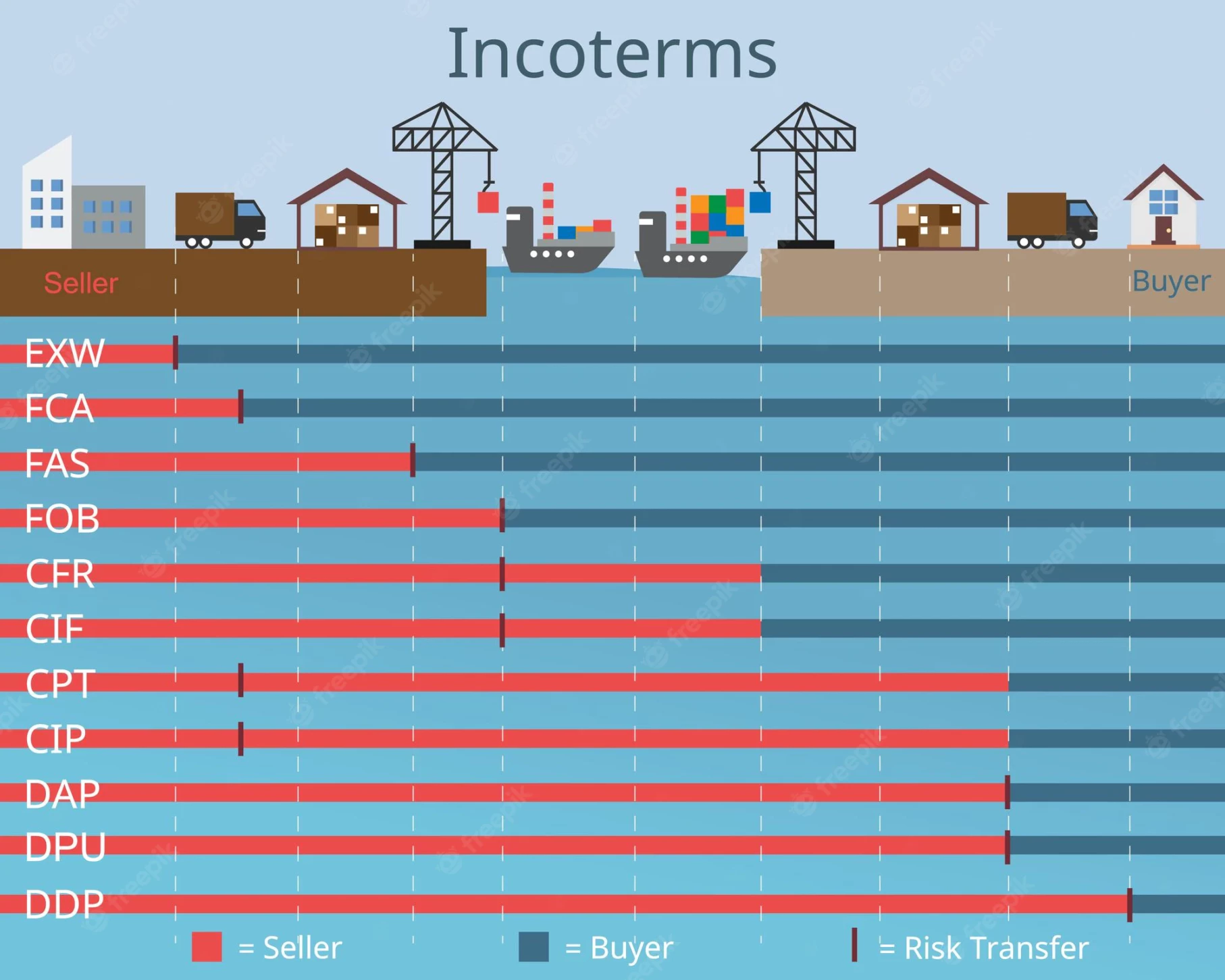

INCOTERMS DAP and DDP are two essential terms for international shipping and trade. Whether you are a business owner, logistics manager, or just someone looking to understand the international trade process better, having a comprehensive understanding of these terms is essential. DAP (Delivered at Place) and DDP (Delivered Duty Paid) are two of the most commonly used INCOTERMS. They both define who is responsible for the cost and risk associated with a shipment. This guide will provide a thorough overview of these two terms, explaining their differences, the implications for the shipper and receiver, and how to best use them when trading internationally. After reading this article, you will be better prepared to make informed decisions and confidently negotiate international shipping contracts.

What is DAP?

Delivered at Place, abbreviated as DAP, is one of two commonly used INCOTERMS (also known as commercial terms). The other one is Delivered Duty Paid, described below. DAP refers to when an item is delivered to an agreed upon place, that doesn’t have to be the end destination of the goods. DAP is used when the seller is responsible for the transportation costs from their location to the agreed-upon place of delivery. The agreed-upon place of delivery can be any location agreed upon by both the seller and buyer. To use DAP as the commercial term, the seller must prepare the goods for export by completing any required customs and other government documentation. The seller also needs to arrange for the transportation of the exported goods to the agreed-upon delivery place. The buyer only needs to ensure that the agreed-upon delivery place is accessible and provide assistance if required. DAP is commonly used when the seller provides the goods to an end user within the same country or region (e.g. within EU.) where no specific import clearances or licenses are needed.

What is DDP?

Delivered Duty Paid, abbreviated as DDP. DDP refers to when an item is delivered to the agreed-upon location (a place or a port) and the seller takes responsibility for the full cost and risk of goods, including the customs clearance. This includes paying any taxes and duties, as well as obtaining any required import licenses. The agreed-upon place of delivery can be any location agreed upon by both the seller and buyer. The most common delivery place is the receiver’s warehouse.

Comparison of DAP and DDP

The main difference between DAP and DDP is that the seller only has to obtain all necessary export permits on DAP terms, but also has to obtain the import permits on DDP terms. The same counts for the costs, where the seller on DAP terms is responsible for all costs associated with the shipment, excluding import fees which have to be covered on DDP terms.

Benefits of DAP and DDP

-

Increased certainty in the export process.

When shipped under DAP, the seller is responsible for the export process. This can help to reduce the risks associated with the process, as well as any delays that may occur. Additionally, the seller may be able to expedite export clearance, which can reduce the time your shipment is held up at the border.

-

Reduced risks for importers.

With DDP, the seller assumes responsibility for obtaining any necessary import permits and paying any applicable taxes or duties. This removes some of the risk for importers, who might otherwise be responsible for these costs.

-

Higher quality goods.

When you ship under DDP, the seller is legally required to provide full documentation and ensure that the goods are imported to the destination. By keeping the seller responsible for the import, you give the seller an incentive to delivery high-quality goods that they are confident will pass an eventual inspection.

How to Choose Between DAP and DDP

If you are importing goods to a region requiring special import clearances or licenses that you are uncertain of handling, consider buying your goods DDP, which will leave this responsibility to the seller. If you are in the same region of the goods, or if you have your own import licenses that you need to use to import the goods, the correct term to use is DAP.

If you are interested in learning more about INCOTERMS consider reading our guide on CIP vs. CIF and EXW vs. FOB.