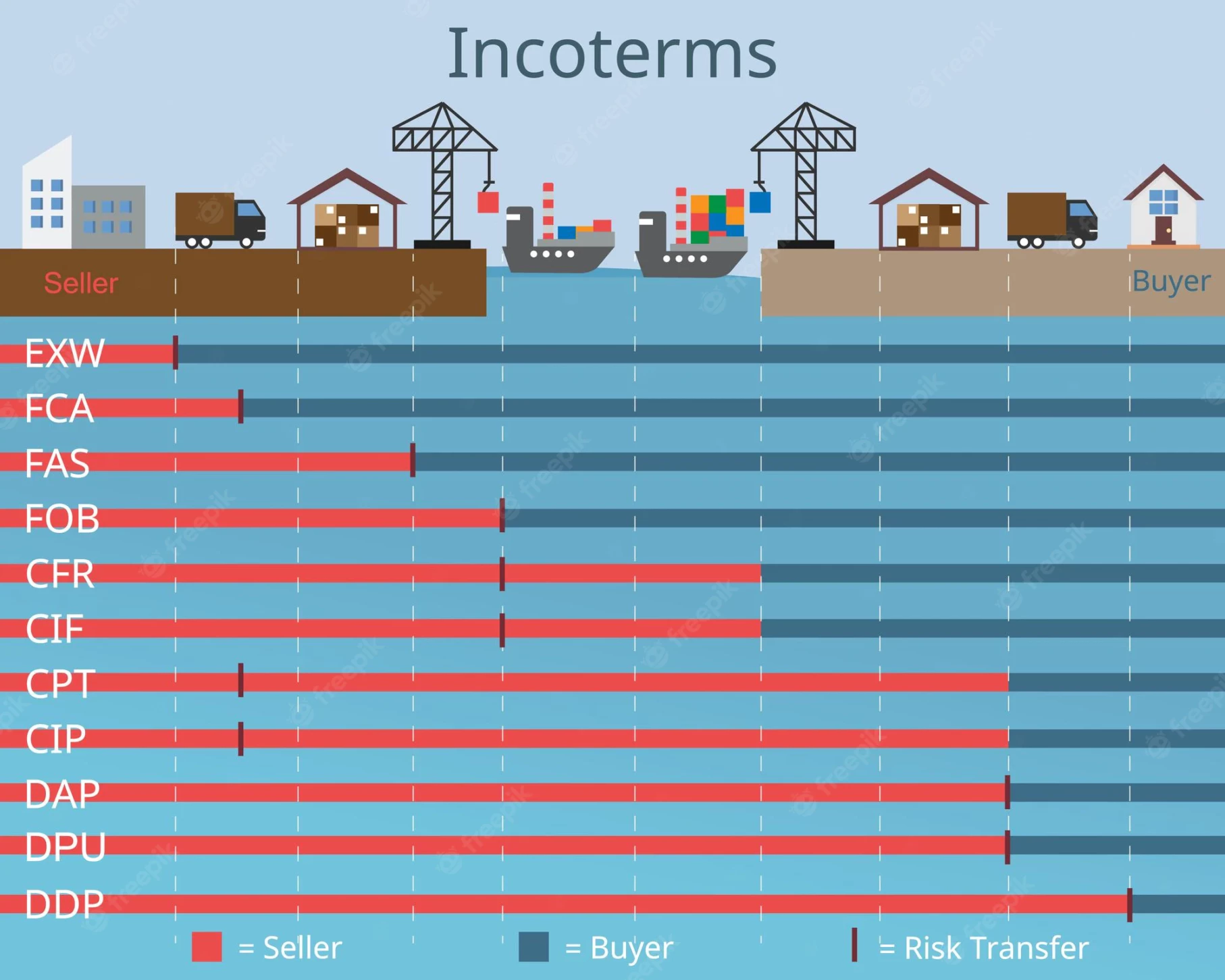

When it comes to global trade, one of the most important aspects to consider is the Incoterms. The Incoterms, or International Commercial Terms, are a set of rules that outline who is responsible for what in a global trade transaction. This article will unpack two commonly used Incoterms, CIF, and CIP, and discuss their differences, benefits, and risks. By the end of this article, you will better understand how to choose the right Incoterms for your trade.

Introduction to INCOTERMS

The Incoterms, or International Commercial Terms, are a set of rules that define who is responsible for what in a global trade transaction. They are used to specify the responsibilities of the buyer and seller in international trade. The Incoterms are used by both parties in order to avoid potential misunderstandings and disputes. They are also used to determine which party is responsible for the cost of transport, insurance, and other costs associated with the transaction.

What is CIF?

CIF is an Incoterm used in international trade agreements for physical shipments. CIF stands for “Cost, Insurance, and Freight” and indicates that it is the seller’s responsibility to cover all costs associated with exports, the insurance of the goods, and the freight of the goods until the point where the goods are unloaded at the destination harbor. The buyer takes responsibility and risk of handling the shipment, from the point where the goods depart the harbor of origin. CIF is used for sea freight only and the buyer is responsible for all other costs associated with the transaction such as importing the goods, customs duties, and taxes.

What is CIP?

The CIP Incoterm stands for “Carriage and Insurance Paid To” and is similar to the CIF Incoterm in that it is used for physical shipments. CIP does not assume that the goods are departing and arriving at a harbor and can be used for all shipments, not only sea freight.

When using the CIP term, the buyer and seller agree on the final destination, “Place”, and the seller is responsible for making sure that the cost of carriage and insurance is paid up to that agreed destination. Still, it is the buyer’s responsibility and risk to handle the shipment after the goods have reached the first carrier tasked with transporting them. Like with CIF, the buyer is responsible for importing the goods, customs duties, and taxes when buying CIP.

Differences between CIF and CIP

One key difference between CIF and CIP is that the destination of the contract might be the buyers warehouse in a CIP contract, but always the destination harbor in a CIF contract.

Another key difference is that the buyer in a CIP contract takes full responsibility and risks handling the shipment after the goods have reached the first carrier, even though the seller is paying for freight and insurance until the end destination. In a CIF contract, it is the full responsibility and risk of the seller to take care of the goods until they depart at the harbor of origin.

Finally, CIF can be used for sea freight only.

Benefits of Using CIF and CIP

The main benefit of using CIF and CIP is that they provide a clear set of rules and expectations that both parties in the transaction must follow. This helps ensure that the transaction is conducted fairly and transparently, which can help reduce the risk of misunderstandings and disputes.

Another benefit of using CIF and CIP is that they provide a degree of protection to the seller and the buyer. In both contracts, an insurance must be in place before the goods leave the seller. This provides confidence that no matter what happens to the goods during their journey to the buyer, insurance will cover it.

Finally, CIF and CIP are relatively straightforward Incoterms to understand and use, making them ideal for small and medium-sized businesses that are new to international trade.

What are the Risks Involved in Using CIF and CIP?

INCOTERMS are used to minimize risk, as the rules are internationally accepted. But there is always a risk that the buyer may not be able to pay for the goods or the seller may not be able to deliver them. This even though the terms explicitly sets the rules.

Another common risk is currency fluctuations, which CIF and CIP natively don’t provide any protection against.

Tips for Choosing the Right Incoterms

When choosing an Incoterm, it is essential to consider the specific needs of the buyer and seller. Each Incoterm comes with its own set of responsibilities, so it is crucial to understand what each entails before making a decision.

It is also essential to consider the risk involved in using each Incoterm. Some Incoterms offer more protection to the seller than others, while some offer more protection to the buyer. Understanding the risks associated with each Incoterm is vital before making a decision.

Finally, it is essential to consider the cost of the transaction. Different Incoterms have different costs associated with them, so it is important to make sure that the cost of the transaction is within the budget of both parties.

Are you interested in more about INCOTERMS? Please read our guide for choosing between EXW and FOB and DAP and DPP.